Alluvial Team Forms to Build an Enterprise-grade Liquid Staking Standard

Today we're excited to announce the formation of Alluvial, a team founded to build an enterprise-grade liquid staking standard.

Today we're excited to announce the formation of Alluvial, a team founded to build an enterprise-grade liquid staking standard. This standard will help bridge capital from institutions to Proof of Stake blockchains increasing the security necessary for the web3 economy to grow.

Staking: Crypto's Most Durable Reward Rate

Staking requires token holders to lock their tokens in the protocol. This provides additional security to the protocol in the same way as devoting hash power to a Proof of Work protocol, such as Bitcoin. Token holders who stake earn rewards in the form of the native token for providing security to the protocol. Relative to lending and liquid provisioning, staking provides a stable rewards rate (“Proof of Stake Worst Case Fixed Yield”). Rewards are driven by utilization of the network, not external factors such as trading activities. Plain and simple, staking rates tend to be among the most stable in the digital asset ecosystem.

The main drawback is that token holders who wish to withdraw their staked tokens are subject to an unbonding period, which limits the liquidity of the staked tokens. The unbonding period impedes liquidity, especially for institutions accustomed to more traditional liquid capital markets. Holders are then left with a choice between staking to secure the network or pursuing trading opportunities in DeFi.

Liquid Staking: Layering on Capital Efficiency

Liquid staking allows token holders to stake their token and receive a receipt token as evidence of their ownership. This receipt token can be utilized as collateral, lent, or used to provide liquidity strategically. This allows protocols like Ethereum to maintain security while unlocking liquidity, increasing capital efficiency for liquid stakers. While this liquid base layer unlocks new opportunities for token holders, it also lays the foundation for a new ecosystem of financial products to be built.

The need for liquidity has been validated by the market growth we've seen on Ethereum where liquid staking has grown from under 1% to 35% of total staked tokens over the past 12 months. This trend may continue over the coming year as more institutions enter the staking market and expect more capital efficiency.

Unmet Institutional Needs

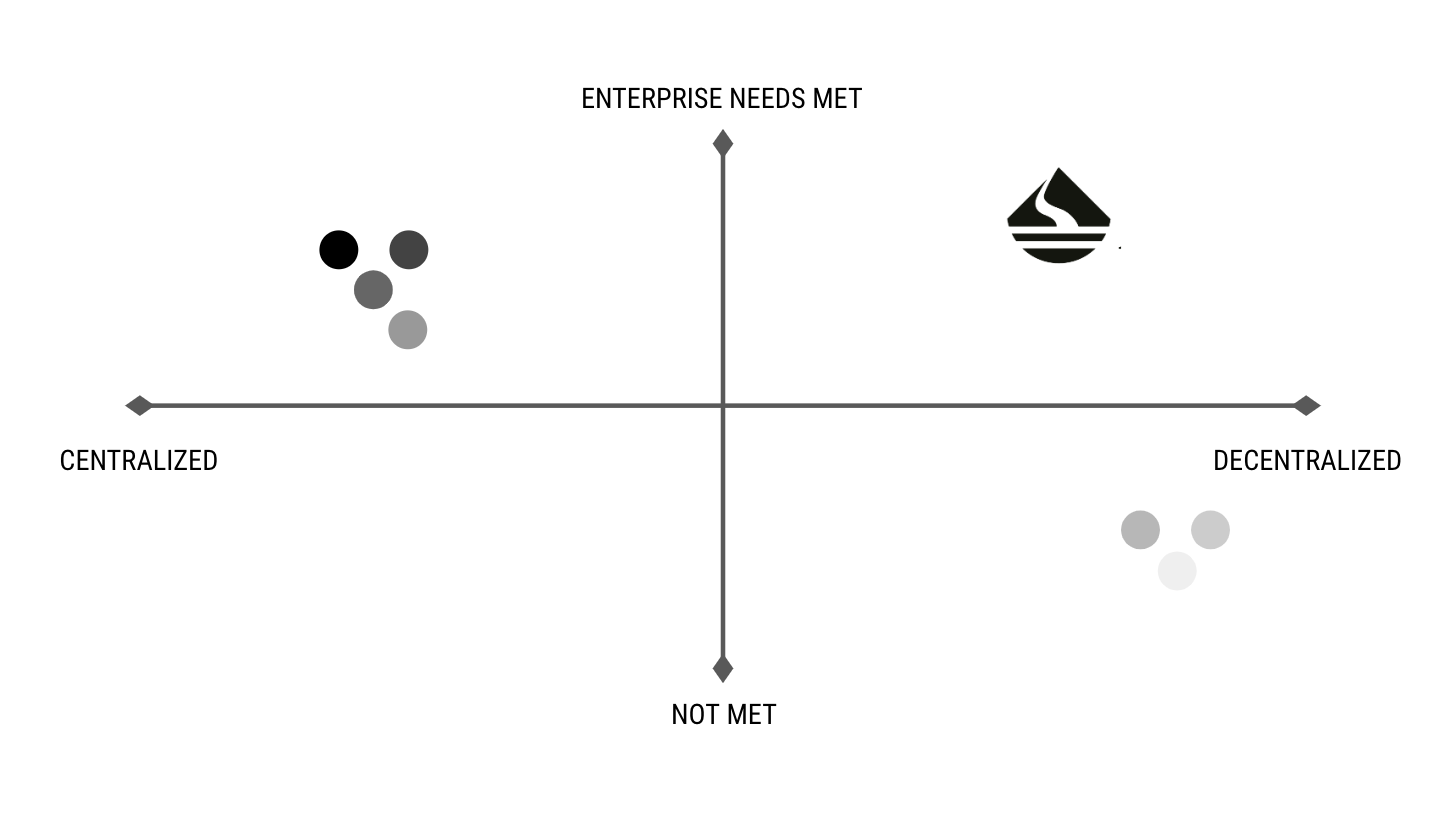

The liquid staking market exists on two separate ends of the spectrum today. On one end: crypto-native, decentralized protocols have built innovative solutions. However such protocols don't meet the needs of institutions from a compliance and security perspective. On the other end of the spectrum: large custodians and exchanges have “liquid” staking where tokens are pooled together, staked and the staked collateral may be used on platform. While this solution meets the needs of the institutional customer, it is not capital efficient and centralizes stake in one entity.

If both ends of the spectrum continue to push out, we'll see a decentralized solution that many token holders cannot use on the one hand, and on the other hand, centralized stake that undermines the security of the network. Both outcomes will prevent the liquid staking market from reaching its true potential: a secure, decentralized, and capital efficient ecosystem.

Collaborating to Deliver the Institutional Liquid Staking Standard

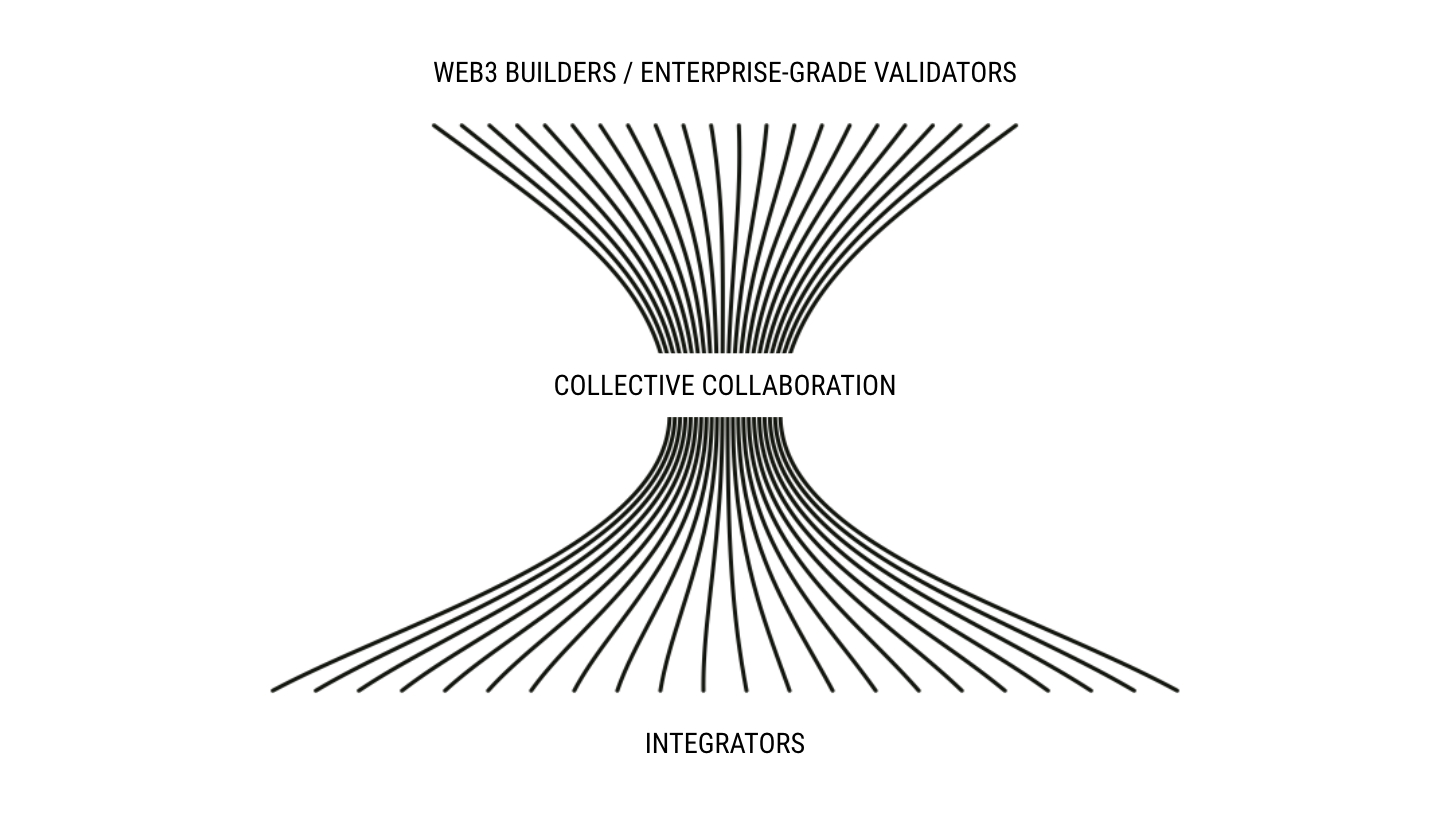

By working together with Web3 builders, enterprise partners, and leading validators, we want to create a standard for institutional liquid staking. Our liquid staking protocol, initially developed on Ethereum, aims to be the model for this standard. The protocol implements features that cater to the needs of mature businesses, such as KYC/AML checks, enterprise-grade security, and robust monitoring and reporting.

From the start, Alluvial intends to carry forward the vision of the blockchains that we build on, aiming to align on operational standards that will encourage client diversity, multi-region infrastructure configurations, and other robust security practices from leading operators. We believe this all results in a more reliable and secure protocol that is designed to meet the requirements of our enterprise users.

Bringing this standard to users, across multiple chains will require a community of developers, service providers, validators and other ecosystem participants. From distributors to provide KYC/AML checks and seamless on-ramps, to Web3 builders to scale the model to other protocols, and leading validators such as Figment and Coinbase Cloud. Alluvial intends for the protocol to ultimately be governed by a DAO with broad industry participation.

The talented founding team driving this effort has 25 years of combined experience across capital markets, fintech, and crypto.

As experienced operators across multiple industries, we understand the higher bar that institutions set as well as how to build in an open and transparent way with the Web3 community.

If you're interested in learning more about becoming a contributor to this standard or as a Web3 builder, please reach out to the Alluvial team below.

Please note

Liquid staking via the Liquid Collective protocol and using LsETH involves significant risks. You should not enter into any transactions or otherwise engage with the protocol or LsETH unless you fully understand such risks and have independently determined that such transactions are appropriate for you.

Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or a complete discussion of the risks that are mentioned. The material contained herein is not and should not be construed as financial, legal, regulatory, tax, or accounting advice.