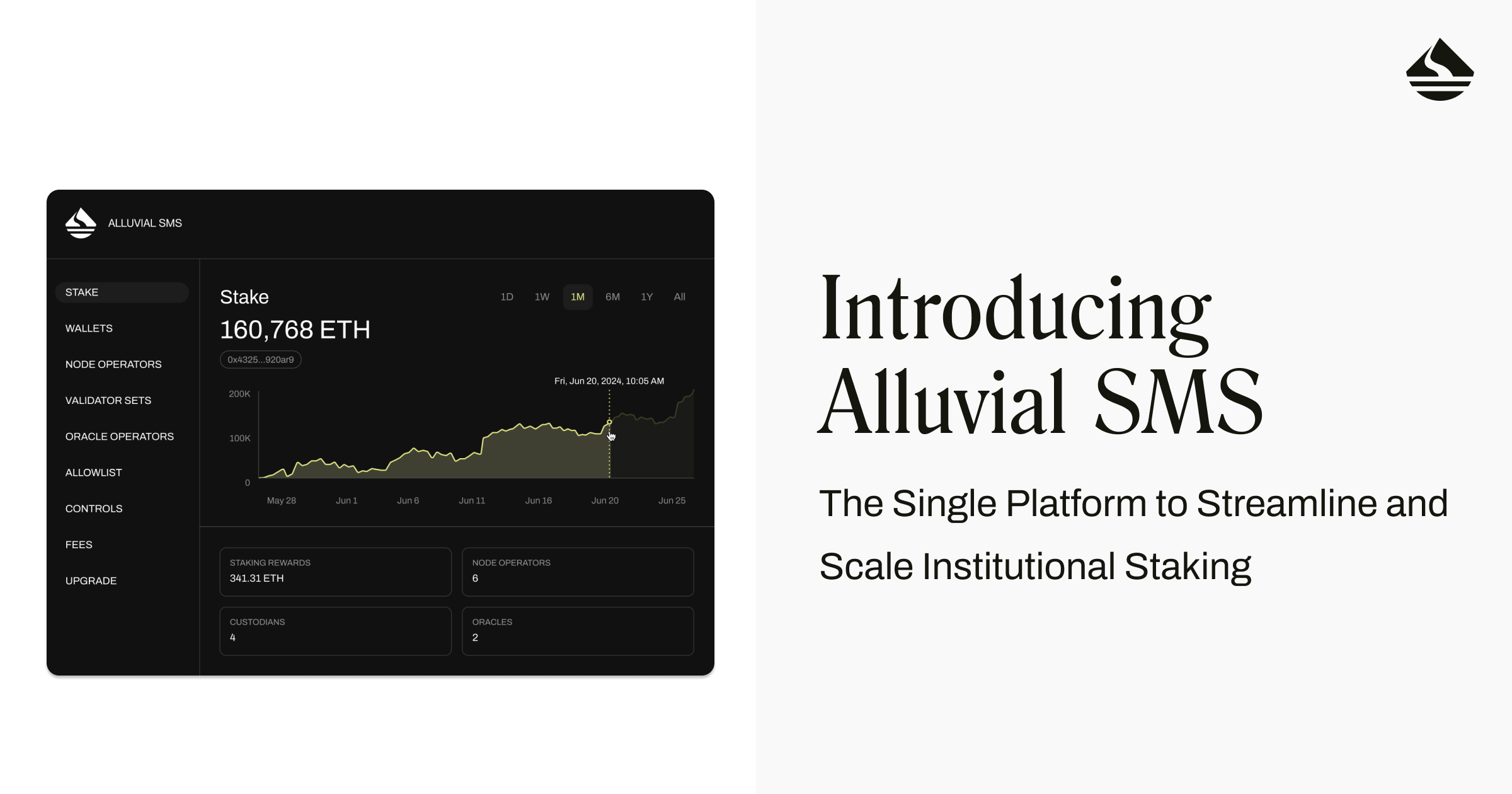

Introducing Alluvial SMS: The Single Platform to Streamline and Scale Institutional Staking

Alluvial Stake Management System is a unified solution to automate, control, and simplify staking operations across multiple providers, optimizing staking management for long-term success.

Alluvial is proud to launch Alluvial Stake Management System (SMS)—a fully customizable staking management platform that’s purpose-built to address the needs of institutions, asset managers, ETFs, and ETPs navigating the complexities of today's digital asset ecosystem.

As staking adoption accelerates globally, institutions are done leaving network rewards on the table—and Allluvial SMS unlocks this growth with a scalable solution. Unlike traditional physical staking, Alluvial SMS makes institutional staking flexible and efficient, empowering businesses to optimize staking strategies through advanced automation and seamless multi-operator configurations.

Alluvial SMS simplifies these processes through a powerful all-in-one-hub for institutions that provides full control over staking operations. It streamlines workflows, unifies reporting, and offers a path to unlock instant liquidity* without compromising security or compliance.

Alluvial SMS offers...

- Diversity: Stake across multiple custodians and node operators via a single, unified interface.

- Risk Management: Protect against correlated failures without sacrificing performance, with one platform to integrate, orchestrate, and report across multiple providers.

- Efficiency: Automate your staking workflows, track rewards, and access unified reporting, while reducing gas costs and complexity.

- Liquidity: Future-proof staking products with access to instant liquidity, through a path to convert staked balances to Liquid Collective’s Liquid Staked ETH (LsETH)*.

- Orchestration: Configure multiple custom, segregated strategies to meet specific goals, while retaining ownership over smart contracts, validator withdrawal credentials, and interoperability.

- Scalability: Stake in any-size increments, and benefit from auto-staked ETH network rewards to offer compounded returns.

“Alluvial SMS is purpose-built to simplify and enhance staking operations, by automating workflows and providing granular control across multiple providers,” said Matt Leisinger, Co-Founder & CPO of Alluvial. “As the staking ecosystem matures, institutions require secure, performant tools to manage complex operations efficiently. Alluvial SMS delivers the flexibility and scalability needed to unlock the full potential of staking while addressing the rigorous standards of today’s institutional landscape.”

“The launch of Alluvial SMS comes at a pivotal moment, with institutional adoption of digital assets surging and unprecedented inflows to crypto funds. The clear trend for these products globally is toward integrating staking to offer optimized returns via ETH network rewards, and using diverse operators to mitigate the risk of correlated failures,” said Evan Weiss, COO of Alluvial. “By combining advanced automation, seamless orchestration to mitigate risk through operator diversity, and efficient liquidity solutions, Alluvial SMS empowers asset managers to unlock the full potential of staking participation. We’re excited to help market-leading institutions participate in the onchain economy with confidence and control.”

This launch builds on the momentum of Alluvial’s strategic round announced last week. Backed by market leaders like F-Prime Capital (the venture capital firm affiliated with FMR, LLC, the parent company of Fidelity Investments) and Brevan Howard Digital, this latest funding underscores traditional institutions’ confidence in Alluvial’s ability to address the growing demand for secure, enterprise-grade, configurable staking solutions.

An at-launch Alluvial SMS adopter is Pier Two, an Australian-based, enterprise staking and infrastructure services provider, who will use Alluvial SMS to launch a solution for wallets and exchanges to offer non-custodial ETH staking to their users. Established in 2018, Pier Two services funds, ETF issuers, custodians, exchanges, and other institutions.

Alluvial and Liquid Collective, the trusted and secure staking standard, are collaborating to develop a conversion path from Alluvial SMS to Liquid Collective’s LsETH, expected to launch in 2025*. This innovative approach will allow institutions to convert staked balances from an Alluvial SMS to LsETH without requiring validator withdrawals, unlocking instant access to the global liquidity, interoperability, and flexibility of a liquid staking token.

With known, enterprise-grade node operators, compliance checks at the point of mint and redeem for all ETH staked through the protocol, robust risk management, and ecosystem-leading operator standards, LsETH is the only liquid staking solution designed to meet the compliance needs of institutional participants—and Alluvial SMS provides the easiest path for institutions to step into liquid staking instantly and on-demand*.

With Alluvial SMS, asset managers can reduce the operational overhead of staking while confidently participating in a rapidly-growing market, not only meeting today’s requirements of financial institutions, but also positioning them for long-term success in the evolving onchain ecosystem.

To get started with Alluvial SMS, contact us.

*Not all user interface features may be available at launch. Transferable Validator Sets, and the ability to use them to access instant liquidity, the conversion path to LsETH, and other opt-in modules, are expected to launch in 2025. Availability of liquidity may be subject to network and market conditions. Visit alluvial.finance/sms/ to learn more.

Please note

Liquid staking via the Liquid Collective protocol and using LsETH involves significant risks. You should not enter into any transactions or otherwise engage with the protocol or LsETH unless you fully understand such risks and have independently determined that such transactions are appropriate for you.

Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or a complete discussion of the risks that are mentioned. The material contained herein is not and should not be construed as financial, legal, regulatory, tax, or accounting advice.