4 Themes to Watch in 2024, From Alluvial's Mara Schmiedt

Looking forward to a year of infrastructure and cryptographic innovations poised to accelerate adoption.

As we stand on the brink of 2024, themes have emerged that represent a transformative phase for the Ethereum landscape. The expansion of growing cryptographic primitives, scaling solutions, and new frontiers in standardized modeling will unlock new opportunities and challenges in the web3 domain, shaping an ecosystem that is more robust, scalable, and secure.

Here are four key themes that are likely to redefine the Ethereum ecosystem in the year to come.

1. Expansion of reward-bearing tokens

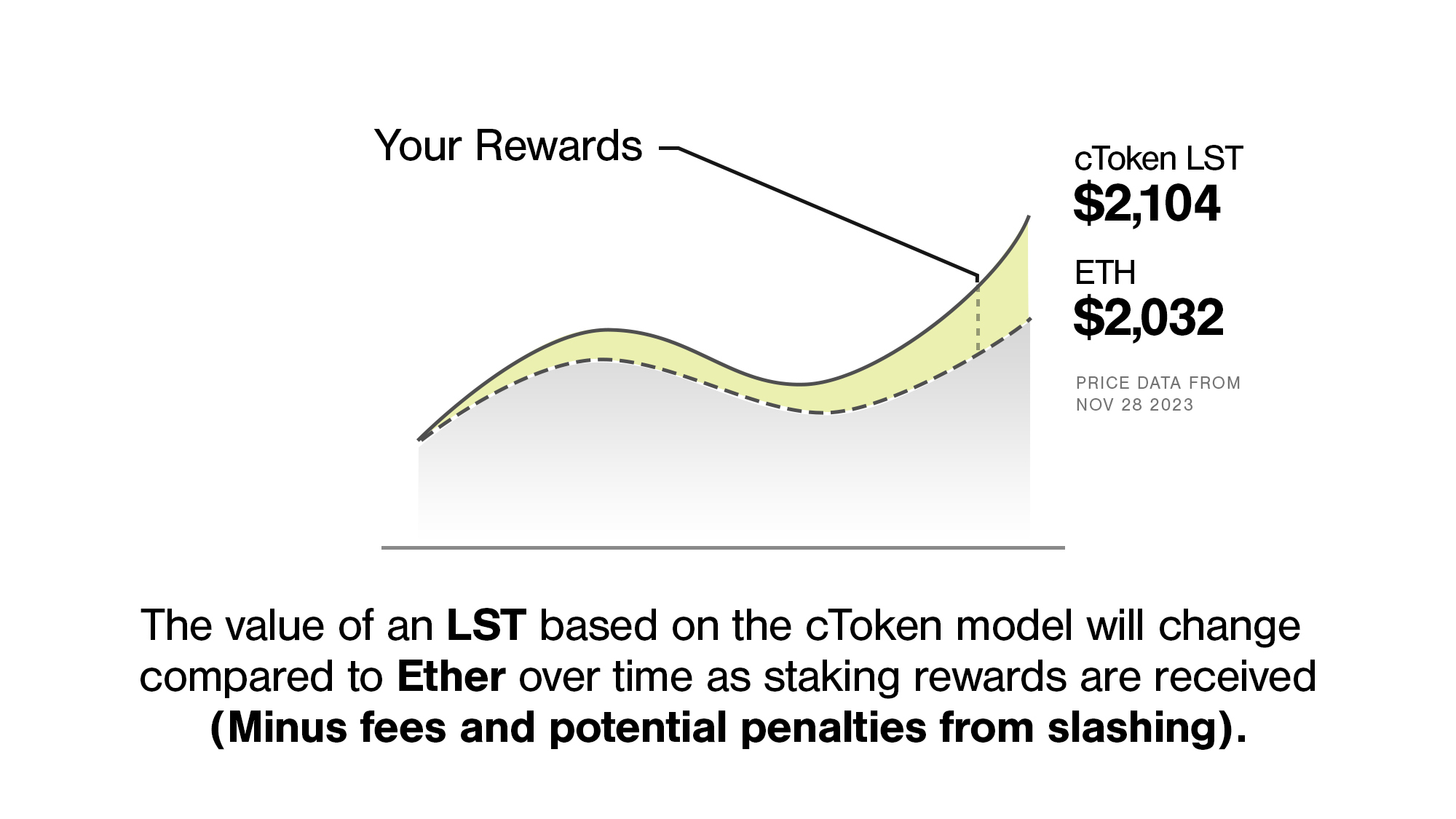

Reward-bearing tokens will supercharge adoption and innovation next year. Originally pioneered by lending protocol Compound’s cToken standard, reward-bearing tokens are quickly becoming the de facto solution for new use cases including liquid staking protocols, such as rETH and LsETH, seeking high functionality and composability for users.

In 2024, the development of reward-bearing solutions for stablecoins is expected to emerge and proliferate. While the adoption of reward-bearing LSTs will continue to grow alongside their integration into the DeFi ecosystem, there is a large opportunity space for innovation—for one example on the horizon, a stablecoin that provides yield from U.S. Treasuries could unlock access to a multi-trillion dollar asset class onchain.

2. Ethereum’s L2 ecosystem and its impact on the market

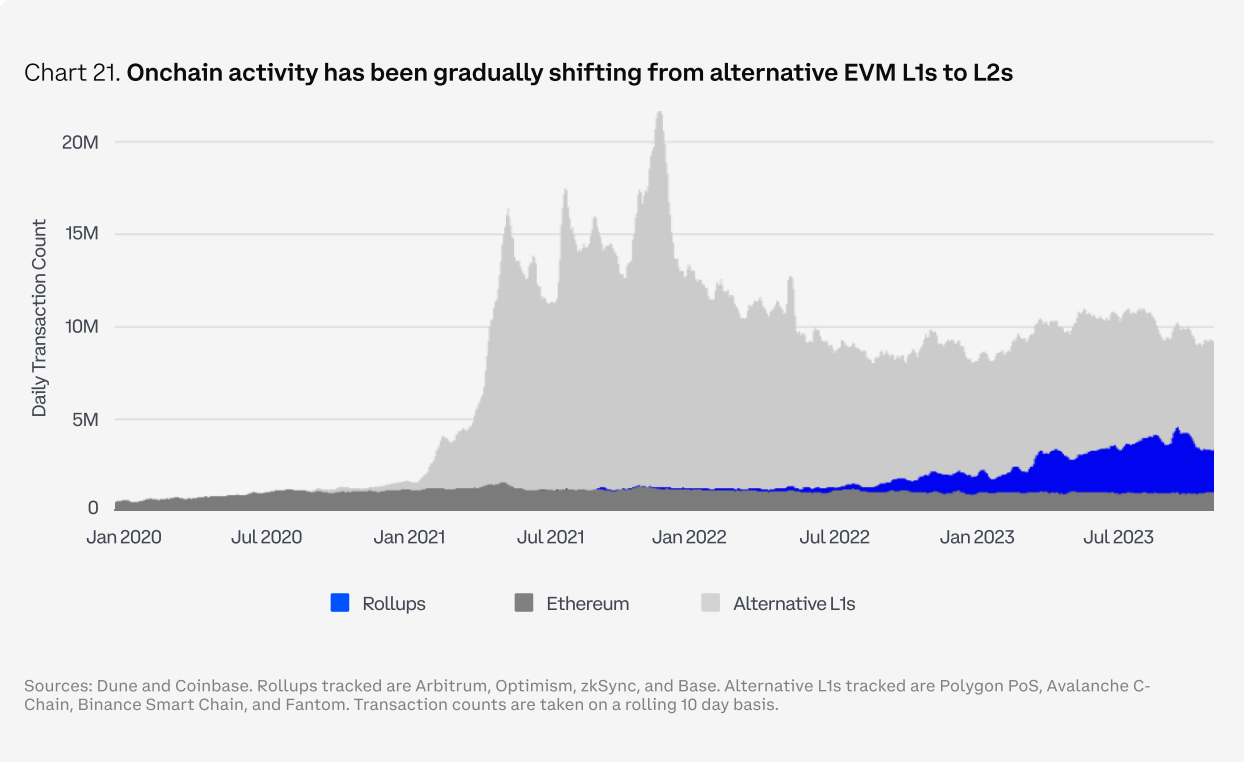

The proliferation of L2s, including the issuance of exchange or platform-specific solutions as pioneered by providers such as Coinbase’s Base, will continue to accelerate Ethereum’s market and developer dominance in 2024.

Alternative L1s will find themselves in an increasingly challenging competitive position that will likely translate into further sector specialization or migrations from L1s to Ethereum L2s, such as recently announced by Celo.

While presenting a significant improvement for scalability, the explosive growth of L2s will create significant interoperability and composability challenges for developers and users. This will put the need for cross-layer interoperability at the forefront of the development agenda.

3. Advancements in Distributed Validator Technology (DVT)

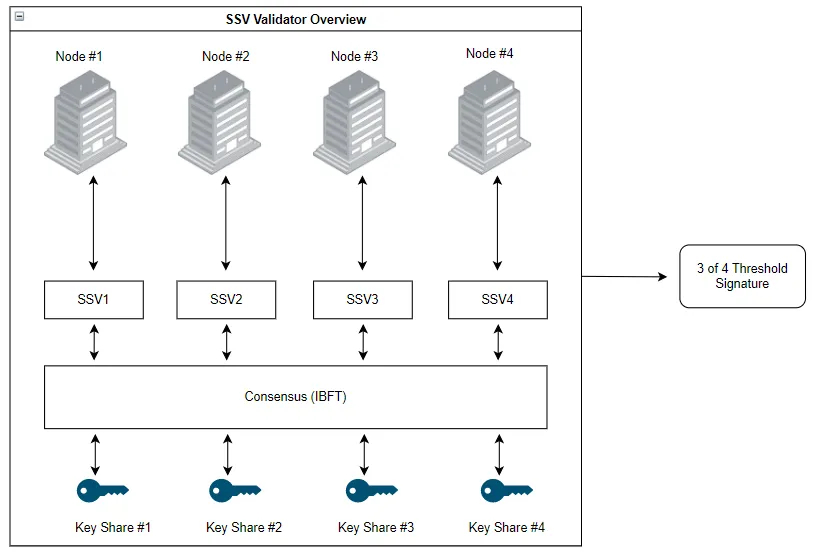

The advancement of Distributed Validator Technology (DVT), which enables the splitting of validator keys across node operators, will improve Ethereum’s network resilience and pave the way for more distributed, diversified and pooled staking operations.

Following extensive testing in 2023, DVT is expected to be a key technology component of most professional node operators and liquid staking protocols looking to mitigate single points of failure in 2024.

4. New frontiers in data tooling and standardized modeling

Data tooling and advancements in standardizing performance and risk modeling for Ethereum validators, pioneered by solutions such as Rated and Coinfund’s CESR, will form the basis for new financial products expected to emerge in 2024 including index, credit and hedging solutions in DeFi and CeFi.

The combination of maturing security-enhancing middlewares such as DVT with the expected advancement in data tooling to assess the performance and risk associated with node operations will help mature and improve pricing for much needed staking insurance products.

2024 is shaping up to be a landmark year in the Ethereum ecosystem. In addition to changing network dynamics, with the Dencun upgrade expected in Q1 and adoption of liquid staking technology continuing to grow, these four emerging themes may drive broader adoption, improve network security and scalability, and foster the creation of more sophisticated onchain products. I’m excited to continue building toward this future with our team at Alluvial!

EXECUTIVE BIO

Mara Schmiedt, is CEO and Co-Founder of Alluvial, the development company behind Liquid Collective. She previously worked at Coinbase as Head of Sales for Coinbase Cloud, managed Business Development at Bison Trails, and served as Strategy Manager at ConsenSys. Mara is a board member at Obol Labs, a leading DVT provider, and a strategic angel investor in over 20 projects. Passionate about open-source technology, she has published research on liquid staking and led a working group with the Ethereum Foundation that developed the Ethereum Launchpad and the first DVT proof of concepts.

Please note

Liquid staking via the Liquid Collective protocol and using LsETH involves significant risks. You should not enter into any transactions or otherwise engage with the protocol or LsETH unless you fully understand such risks and have independently determined that such transactions are appropriate for you.

Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or a complete discussion of the risks that are mentioned. The material contained herein is not and should not be construed as financial, legal, regulatory, tax, or accounting advice.