Pectra-Optimized Staking with Alluvial SMS

Leverage the benefits of Ethereum’s Pectra upgrade for optimized performance, enhanced control, and improved capital efficiency.

By Dimiter Georgiev, Alluvial Senior Product Manager, and Julia Schmidt, Alluvial Blockchain Engineer

Ethereum's May 2025 Pectra upgrade marks a significant evolution for the network, introducing enhancements that will reshape the staking landscape. For institutions, asset managers, and ETF issuers developing advanced staking strategies, optimizing for these changes represents an opportunity to gain an edge in staking efficiency and network reward rates.

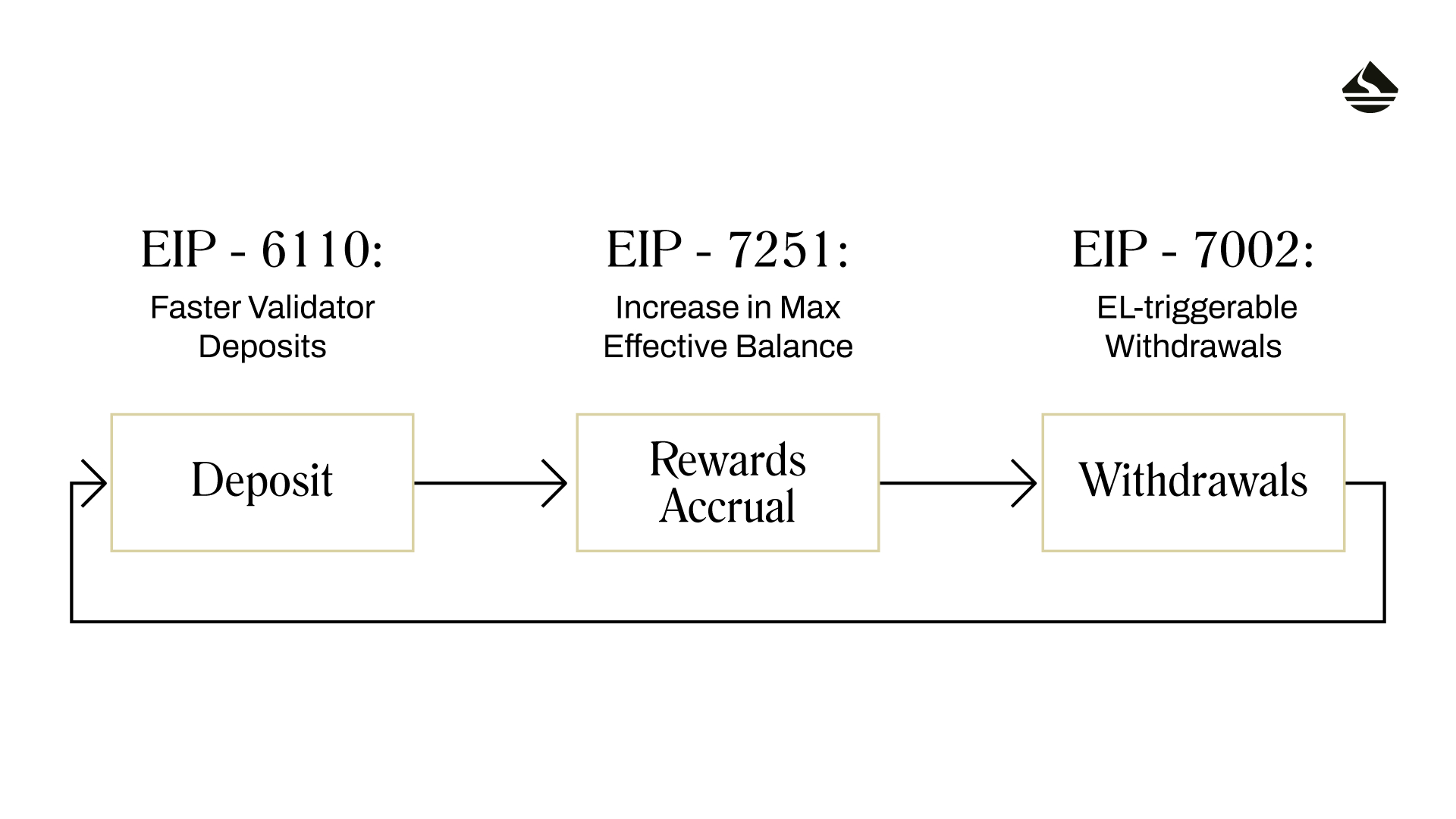

Alluvial Stake Management System (SMS)’s latest release has introduced a Pectra-ready architecture, ensuring institutions can seamlessly leverage the upgrade's benefits for optimized performance, enhanced control, and improved capital efficiency.Pectra bundles several Ethereum Improvement Proposals (EIPs), with key changes impacting staking operations:

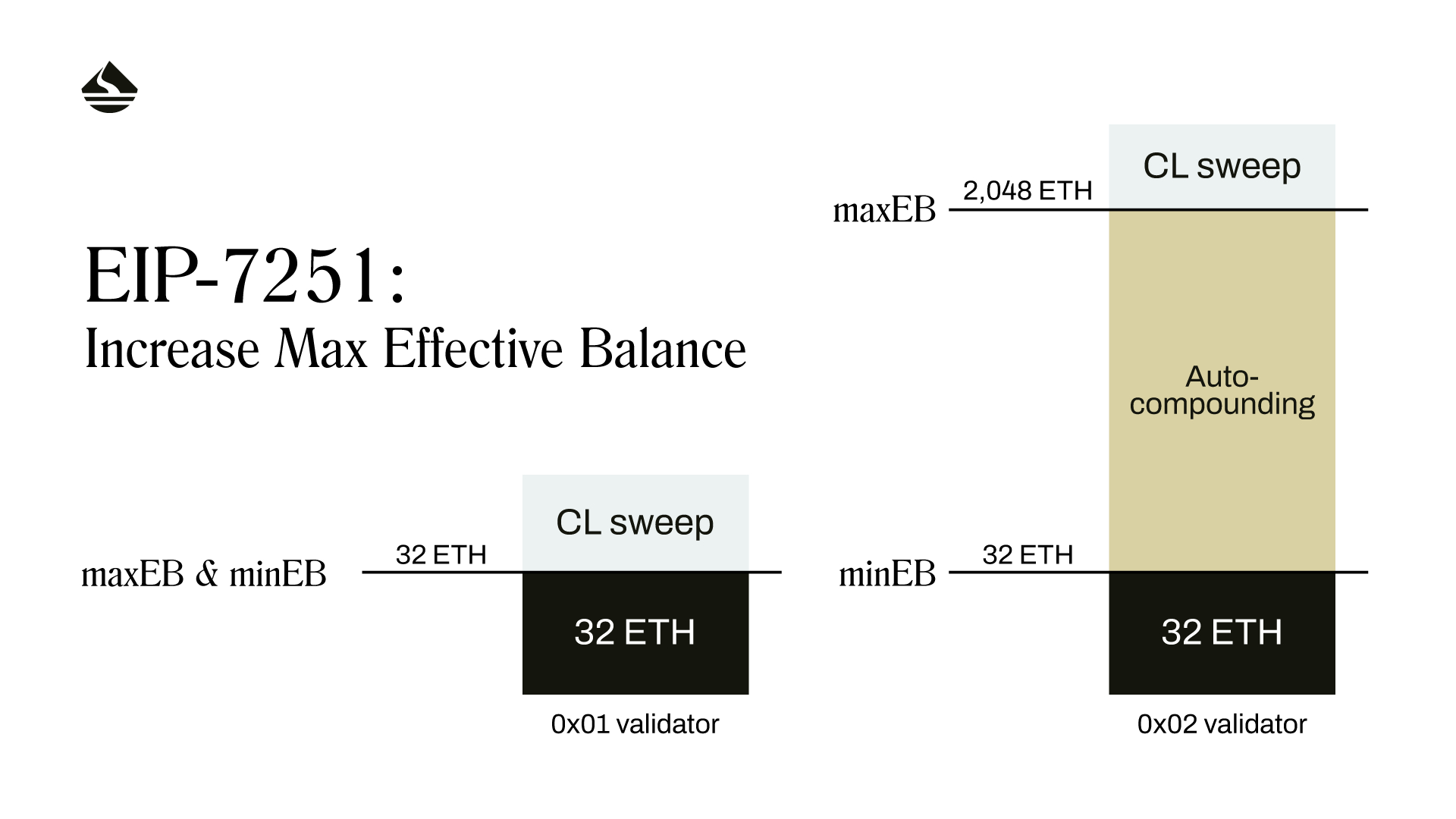

- EIP-7251 (Increase Max Effective Balance): Raises the maximum ETH per validator from 32 ETH to 2,048 ETH.

- EIP-7002 (EL-Triggerable Withdrawals): Allows validator exits and partial withdrawals to be initiated directly from the execution layer (EL) using withdrawal credentials.

- EIP-6110 (Faster Validator Deposits): Streamlines the deposit process, reducing the time it takes for new stake to become active.

Here are three key ways that Alluvial SMS is engineered to harness the staking advancements introduced by Pectra.

1. Improved capital efficiency (EIP-6110)

- Faster validator activations: By eliminating complexities in the deposit process, EIP-6110 reduces the delay for activating new validator deposits from hours down to minutes (assuming no activation queue). SMS v2 users benefit from this acceleration, meaning their capital starts earning rewards sooner.

- Introduces network efficiencies: EIP-6110 also removes the Ethereum network’s limit on a number of staking deposits that can be made per epoch, making the per-block gas limit the only cap. This increases the overall efficiency of staking activations, potentially reducing the queue to make staking activations even faster.

2. Leveraging higher validator balances (EIP-7251)

- Validator consolidation & cost reduction: Alluvial SMS now supports the transition for validators to have an increased maximum effective balance (up to 2,048 ETH). This allows institutions to consolidate stake into fewer validators, significantly reducing operational overhead, infrastructure maintenance, and cloud compute costs.

- Auto-compounding CL rewards: The higher balance per-validator enables automatic compounding of consensus layer (CL) rewards, eliminating the need for frequent, gas-intensive transactions to create new validators for compounding in 32-ETH increments.

- Optimized slashing risk: While consolidating stake might seem like a risk for a higher slashing penalty, EIP-7251 adjusts the initial slashing penalty calculation, making it less severe relative to the total stake compared to the pre-Pectra penalty for a 32 ETH validator. Alluvial SMS users can set optimal effective balance caps based on their specific risk tolerance and liquidity needs, automatically allocating stake across validator node sizes to maintain a custom, automated strategy.

3. Enhanced withdrawal flexibility (EIP-7002)

- Owner control & reduced operator dependency: Alluvial SMS now offers support for EL-triggerable withdrawals. This empowers the withdrawal credential owner (typically the Alluvial SMS customer) to initiate full exits or partial withdrawals directly, without relying solely on the node operator who holds the active validator key. This significantly reduces counterparty risk and the need for complex solutions like pre-signed exit messages, increasing both speed and security.

- Faster partial withdrawals: EL-triggered partial withdrawals can bypass the main withdrawal queue, potentially offering faster access to liquidity compared to full validator exits.

- Considerations for exit fees: While CL-triggerable exits will remain free of cost post-Pectra, the price for EL-triggerable exits will increase exponentially with the number of requests that have been submitted simultaneously. This creates options for robust liquidity and risk mitigation strategies, with CL-triggerable exits remaining the no-cost option and EL-triggerable exits mitigating dependency on node operators for withdrawals.

View our Partial Exits | Fees & Exit Time Calculator here, and download a copy to evaluate the EL-triggerable dynamic fee calculation.

Future-proofing institutional staking

Beyond these specific EIPs, the Pectra-ready architecture introduced in our latest Alluvial SMS release facilitates further optimizations, such as the programmatic reallocation of stake across node operators based on performance metrics.

As Ethereum evolves with the Pectra upgrade, having staking infrastructure that is not just compatible but optimized for the new environment is crucial. Alluvial SMS provides institutions with the control, automation, and flexibility needed to navigate these changes confidently, manage risk effectively, and optimize staking returns in the post-Pectra era.

To talk with our team about powering your staking strategy on Alluvial SMS, contact us. Stay up-to-date with the latest Alluvial SMS developments by following @alluvialfinance on X or Alluvial on LinkedIn.

Please note

Liquid staking via the Liquid Collective protocol and using LsETH involves significant risks. You should not enter into any transactions or otherwise engage with the protocol or LsETH unless you fully understand such risks and have independently determined that such transactions are appropriate for you.

Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or a complete discussion of the risks that are mentioned. The material contained herein is not and should not be construed as financial, legal, regulatory, tax, or accounting advice.